Low Demand PTA Weak Situation Stand Still

Author: Mar 31, 2011 14:07

|

Recently, the Japanese earthquake and Libya War boost crude oil price high. The strong earthquake has lead PX spot goods price increase greatly, boosting PTA price rebound from low price. However, for the coming of traditional busy season and at the time of slack PTA demand, which greatly disturb the PTA market, not only on its spot goods market, but also on its future goods. Now PTA spot goods price come to its adjustment period. For the later, for the bare possibility for price rebound and material price will rise up, to my opinion, PTA after market will continue its slack situation. Technically, 1109 contract showed a tubaeform, which means the attitude of waiting for price drop. In my opinion, investors should count on the market trend that will probably weaken follow-up.

Japanese Earthquake panic beginning to wane and Asia PX supply tension is expected to ease.

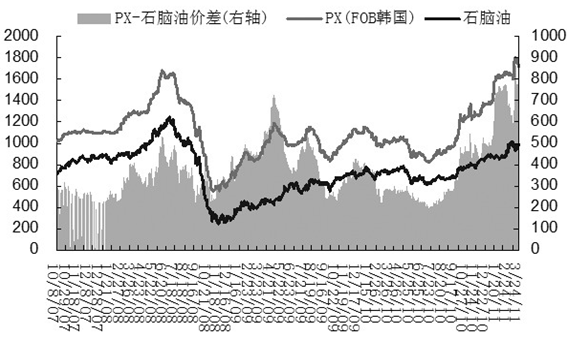

Under the influence of Middle-East tense situation, recently, the global holds a straddle attitude on crude oil price rising. It is believed by the mainstream of the market that crude oil price will probably keep its price over $100 per barrel. If Middle-East situation enlarged rapidly, oil price may be soaring to $150-200 per barrel. As a result, subordinate products like PTA, PE will be benefited. But the push effect on PTA will probably under estimate, for oil price has not soared up synchronically with that of PTA and PX in the second half of last year. Naphtha increase amount is also far behind PX increase amount. Till now, the price difference has reached $700-800/t, which is far more than reasonable price difference, $300-350/t.

Japanese earthquake affected the productivity of 950 thousand tons of PX, which will be recovered in the end of April. Currently, Asia PX crisis is eased, on one hand, Japanese earthquake panic is eliminated and the reconstruction work begins, on the other hand, the 1000 thousand tons of PX products in Urumqi is released to the market, which can remedy the Japanese PX shortage. Meanwhile, Korean S-OIL Corporation PX is put into operation in April. Moreover, the frequent check and repair work in April will reduce PX consumption; therefore, possibility of PX spot goods price mark down is high. Last Friday, Asia PX spot goods price marked $16 down, which is at $1706-1707/t, FOB Korea. PX price is recovered in line with that before the disaster. Evaluate Asia PX price, PTA cost is about 10020CNY/t. At last weekend, PTA spot goods price in Jiangsu and Zhejiang Province is 11600CNY/t, the profit margin is about 1600CNY/t. See from the profit margin, the cost is still unable to form a powerful support for PTA price.

PTA demand is till sluggish

March and May is the traditional busy season of PTA sales. Usually, the focal point of the market is the PTA demand. Since the beginning of this year, in order to inhibit the inflation, the monetary policy takes up, which result in a financial strain in weaving and apparel factories. On the other hand, the inflation also leads to the lack of labor force in the costal area, thus some textile and apparel industries had to increase its labor force cost. In addition with the high price of material and RMB appreciation, PTA demand is inhibited. Moreover, load shedding is put forward under the situation of power shortage. To some extent, the low operation rate of the weaving factories also inhibited PTA demand. Now, domestic PTA demand is still sluggish, without apparent rebound phenomenon. President of Bank of China contended last Friday, RMB appreciation in the future is certain, and the appreciation is expected to be 50% this year. Recently, RMB appreciation speeds up again, which will undoubtedly affect the business of extraverted corporations.

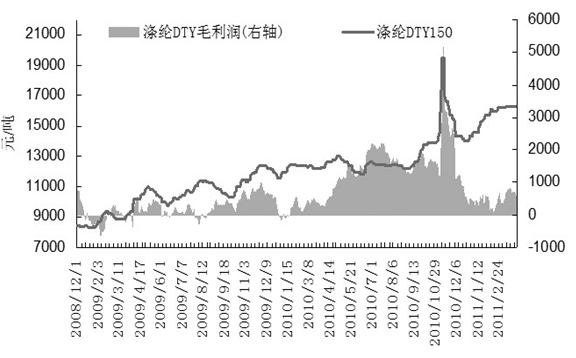

At present, the pressure of textile and apparel industry has been passed on to the poly section. Since the year 2011, profit margin of the poly products like poly fiber, chips, and ect has been reduced greatly, and the price always fluctuate at low. Products price like FDY, Filament chips frequently marked down lower than cost price. Under the influence of cotton price reduction, profit margin of poly staple fiber also shrank. For PTA price increase greatly depends on the replacement of cotton, therefore, whether cotton price will keep under 30 thousand or not, will had great affection on PTA aftermarket. On Monday, under the influence of free tax cotton import, cotton price in Zhengzhou market reduced greatly. Investors should pay attention on aftermarket cotton price trend. More over, tax reimbursement for export is said to be lower down, and if it becomes a fact, PTA demand will encounter one disaster after another.

Installations centralized for repairing, PTA supply reduced.

See from the known PTA installation checking and repairing situation, the repairing work is relatively more in March and April. PTA production reduced greatly. In Far East Petrifaction, the EPTA set stops to check and repair, and it was restarted on 18th Mar, meanwhile, another PTA set stops to check and repair. On 16th Mar, the 900 thousand tons typed PTA set broke down and was restarted on 20th March……But for the notice of check and repair work in advance, the PTA production break off is well adjusted by the market. And the might and main has been transferred to the Sep contract. The repairing work will only brought affect to the recent futures goods price, bare no affect to the Sep contract.

|

Editor: Candy From: 168Tex.com

Most Read