PTA Cost Support by PX is Fading Away

Author: Aug 25, 2011 14:44

|

Since August, PX devices both in China and abroad frequently break down, leading to a short supply that makes PX price firm, without any sign to rebound with the international oil price, narrowing China PTA enterprise profit to 300CNY/t. Since then, a major PX plants stopped production that lessened 700 thousand ton PX from the market, greatly stimulated the market nerve, in addition with multiple favorable factors, PTA price bounce back sharply. The main contract 1201 price broke through the peak of 9800 points, mounting up to ten thousand CNY level. How will PTA price change after the sharply rebound? In my opinion, we can not be too optimistic, mainly for the following factors.

Europe and America economy crisis and the international oil price is unchangeable.

Investors worry about the global economy for the Europe and America debt crisis speculation. Business source have reach a concur on the global economic recovery slacken. See from the economic data published recently, major economies in Europe and America have fall into the situation of stagflation. The double dip possibility risk is further increased. Meanwhile, European central bank restart dollar loan program, aggravating market worries towards sovereign debt crisis.

Under the background of slack global economy, without recovering possibility, global oil price can not recover after a setback. New York oil price has fall back to $30/bbl. Lie hope on the Middle East politics and the summer oil peak is not realistic. In Middle East, after a careful observation of its oil facilities, we can found that threaten of the unrest area to oil transportation facilities is not big. After Libya situation cleared, Middle East oil supply will soon recovered. In America, with the coming of summer oil peak, crude oil stock continues to reduce. But see from the formerly data, the stock amount fall back factor will not be the impetuous factor.

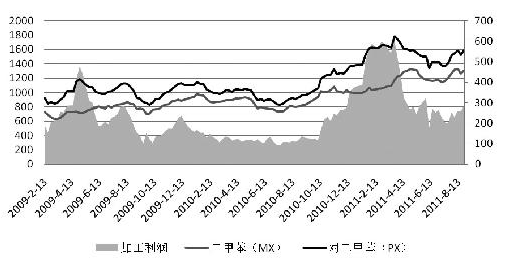

PX production capacity recovered gradually, but its upward room is limited.

In August and September, there are altogether 4290 thousand ton PX device stop to check and repair or break down accidentally, in addition with the domestic 840 thousand ton PX production capacity stopped operation, the market sources are worrying about PX short supply. In the former period, PX price did not rebound with crude oil price, on the contrary, it slightly increased. Currently, PX processing profit is $300/t, which is still in the high range.

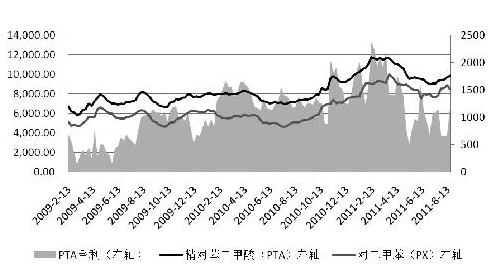

PTA is over supplied and its excessive profit era is over.

According to the original plan, in 2011, there are altogether 4850 thousand ton PTA capacity put into production, and the new devices are mainly in the third quarter and the fourth quarter, among which, in the third quarter, there are 2250 thousand ton put into production. Calculate by 90% operation rate, the monthly production will increase 360 thousand ton in compare with the previous period. But according to the current statistics, the planned production this year is around 4000 thousand ton. In the first half the production plan is 2000 thousand ton, and also 2000 thousand ton in the second half of the year. Averagely, a ton of polyester will consume 0.865 ton of PTA, on the basis of 80% operation rate, the monthly PTA consumption is around 230 thousand ton. Without regard to the importation, only see from the domestic supply, PTA monthly supply still has 130 thousand surpluses. Besides, PTA supply next year will continue to be abundant. And it is estimated that the planned PTA production in 2012 will be over 10000 thousand tons.

Meanwhile, PTA downstream need is still far from being satisfactory. Now, polyester inventory is transmitted to the weaving inventory. Yet, the third quarter is the traditional slack season of textile industry. Under the circumstance of low need both at home and abroad, polyester production and consumption rate is possibly to lower down. Buyers are generally not willing to cover short position.

Such a situation sentenced an end to the PTA excessive profit era. But recently, with a small rebound, PTA processing gross profit come back to 1000CNY/t, which is notably on the high side, for PX price support effect is fading away.

Aftermarket outlook and operation suggestions.

Recently PTA favorable factors mainly come from PX cost support. Under the back ground of unrest global economy and invent preference risk reduce, industry products, including crude oil lack sharply rise condition, instead, it still has some downward pressure. PX, as the downstream products of crude oil can not keep its favorable price. PX is short supplied recently, the price will fall soon after its production recovery and crude oil price fall back. Moreover, PTA price bounce back, PTA processing profit is soon recovered, the cost support effect is fading away.

In the second half of 2011 and 2012, there will be huge amounts of PTA device put into operation, the over supply pressure will be increased, for downstream polyester production capacity will not be able to absorb the superfluous PTA production capacity and the recovery needs time for the depressed textile market.

In a word, PTA still has some speculation subject in the short term, but in the long run, it lacks condition to rise sharply, investors should not blindly chasing high. Currently PTA price will still upward, and it is suggested to sell up when the price reaches 10700CNY/t.

|

Editor: Candy From: 168Tex.com

Most Read