Viscose Staple Yarn: Walk Left? Walk Right?

Author: Sep 23, 2011 15:01

|

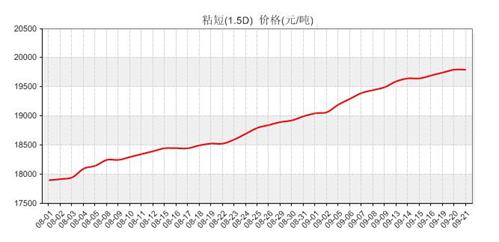

168tex News: Viscose staple yarn quotation has surpassed 20 thousand China Yuan, but few orders have placed at such a high price, thus bring down the market production and marketing rate. Previously, there were plentiful orders, and scarcely new orders, thus stock level increased notably. Recently, upstream feedstock prices have gone strong, which forms an impetuous to viscose staple yarn. But for the busy season is not that as expected, viscose staple yarn price fluctuated around 20 thousand China Yuan, for the actual demand fails to follow-up.

On upstream, currently, linter suppliers up regulated its price for not only once. Now linter quotation has increased to ¥5400-5500/t. Cotton pulp price also increased steadily. Pulp plants hold an optimistic attitude towards the price rising. Now the individually higher cotton pulp quotation has been over ¥12500. See from cotton pulp profit, if linter price is ¥5500, then its pulp cost is around ¥10700, and then cotton pulp profit will be over a thousand China Yuan. Such a big profit margin endows its manufacturer a bigger power to make the decision. Now, with the open up and production recovery, viscose yarn plants have an increasing demand of cotton pulp. Therefore, cotton pulp price rising will surely boost viscose staple yarn price.

In the downstream rayon yarn, rayon fabric market, with viscose yarn price rises, rayon yarn price increase amount is smaller, thus its profit margin is narrowed. In addition, the market demand for rayon fabric has not been bigly increased. Rayon yarn procurement is also according its needs. As is surveyed, there is still over half amount of rayon yarn feedstock in the warehouse, thus rayon yarn price is hard to increase. In this week, the woven 30s yarn is offered at ¥24500/t, knit 30s price is offered at ¥25500/t, and the turn over is not that large.

Since September, rayon fabric turn over is just on average, with its market price keeps stable. And the overall procurement intention is not strong, demand lags behind. As is surveyed, in September, summer wear fabric sales volume lowered down while autumn wear fabric is short supplied. Such as big flower print rayon fabric, viscose yarn fabric, whose spots turn over decreased, thereby brought down fabric price index. But there are also some fabrics that sales as well as before, like rayon linen mixed fabric. As for this fabric, it employs rayon yarn 32/2, linen 14s as its material, weaving through plain construction by air jet looms, especially used for long-sleeved blouse. Now, its wholesale price is around ¥9.00/m. And also a kind of suitcase fabric kept a good sale, which employs poly FDY68D yarn as its warp and 16S rayon yarn as its weft, weaving through jacquard construction on air jet looms. It is the prior choice for high grade suitcase and hand bags. Now its market price is around ¥12/m.

As for cotton, in recent weeks, there is a notable improvement in the cotton market. China cotton acquisition index keeps rising, among which, the average price for 328 grade cotton is ¥19762/t, increasing ¥156/t; 428 grade average price is ¥18519/t, increasing ¥241/t. With cotton price steadily goes up, cotton growers are reluctant to sell out. Weaving plants still prefer to buy in according to needs, and cotton acquisition has not been fully carried out, thus spot price is firm. Cotton price becomes firmer that will brought an impetuous to viscose market.

To sum up, cotton price is to increase, which will give a boost to linter and viscose. Cotton pulp price increased fast, in addition with a strong increase of chemical auxiliary material, bringing viscose staple yarn cost to ¥8500/t, thus viscose manufacturers are still wandering in the edge of profit and loss. Therefore, viscose staple yarn price is impossibly to lower down. In such a busy season that is not as expected, weaving plants are encountering with financial difficulties. Slack demand leads to stock piles up. Yet weaving plants can not hold a sharp feedstock price increase. Therefore, in my opinion, whether viscose yarn price will rise or consolidate, it is greatly depend on who will be the winner in the game that involves upstream and downstream players. If upstream cost rise again, threatening a loss to viscose yarn plants, then, viscose staple yarn price will probably increase. While if downstream rayon yarn, and rayon fabric sale continue to be depress, with low market demand, then viscose staple yarn price will probably maintain a adjust pattern.

|

Editor: Candy From: 168Tex.com

Most Read